Supervisor FAQ

-

I’d like to hire a student employee. Where do I start?

We’re so glad to hear that you’d like to hire a student employee! There are a few things you’ll need to know first before beginning the hiring process.

You’ll need to know:

1. The Supervisory Organization (Sup Org) that the student will be hired into

If you’re not sure if you have a Sup Org or would like more information, please visit our Sup Org FAQ.

If you’re hiring on behalf of a manager, visit our Student Employment Coordinator FAQ for more information.

2. The job description for the job you are hiring for

If the position is new, you will need to create a job requisition for us to review the job description and make sure that the Job Profile you selected is correct.

If the position already exists, we recommend creating a job requisition, unless you are choosing to direct hire. To get the Job Profile and title for the position(s) you already have on your team, utilize the Open Student Jobs report.

Note: Compensation is tied to the Job Profile, and the Student Employment team approves the job profile associated with each job description.

-

A student employee has worked for me before. Does they still have to come to Human Resources to fill out paperwork?

No, student employees only need to fill out their pre-employment paperwork one time during their enrollment years here. However, if they left the University and returned, employment paperwork will likely need to be completed again.

-

Can I give money to students for helping with an event or project?

Providing money to students is highly regulated and typically falls into one of three categories: reimbursement, financial aid, or employment.

If the student is providing a service (e.g., performing or assisting at an event, ushering, creating marketing materials, artwork, or providing translation services), this constitutes an employment relationship. In such cases, students must be treated and compensated as hourly employees.

This means:

-

If it is the student’s first campus job, they must complete pre-employment paperwork before beginning any work.

-

The job must be created in Workday using the SE (Special Event) Job Profile.

-

Use the Direct Hire – SE job aid for guidance on setting up the position.

- Students must clock in and out for each shift, or their manager/timekeeper must enter their hours into the timesheet on their behalf.

Students are not eligible to receive honoraria. If the payment is not for employment, please refer to the Gifts, Prizes, and Awards policy.

-

-

What is a Supervisory Organization? How do I find mine or request one?

Supervisory Organizations (Sup Orgs) are the organizational structure in Workday that connects workers to their manager and to the manager’s unit within the organizational hierarchy of the department. In order to supervise employees in Workday, you must be assigned as a manager of a supervisory organization. In order to supervise student employees, you must be a manager of a job management (JM) sup org, which is indicated in the name of the organization.

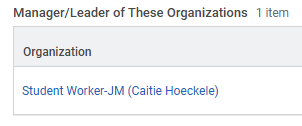

To find your sup org, go to your profile in Workday, click on the ’Job’ tab,

and then the ’Organizations’ tab.

If you are currently a manager of a sup org it would be listed under the ’Manager’ section:

If a sup org is needed and does not yet exist, you may request one by submiting a Workday Org Hierarchy Issue ticket. Note: if there is an administrative assistant who will serve as a Timekeeper for the org, please also note that in your request.

-

How will I know when my Federal Work Study (FWS) student has reached their earnings limit?

There is mostly no business need for a manager to know whether or not a student employee has Federal Work Study. Contact your division’s budget coordinator or the Office of Planning and Budget for questions about student employment hours allotment. If your job qualifies as community work study, contact studentemployment@richmond.edu for FWS elegibility inquiries.

-

What are my responsibilities as a student employee supervisor regarding fraud prevention?

Everyone at the University of Richmond has a stake in preventing fraud. Money spent fraudulently is money that could otherwise have supported student services, academic programs or even salary increases. Not all frauds are financial, even though most high-profile ones in profit-making industries have been. The nature of the higher education environment means that other frauds—from grade changes to research—can also make the news, to devastating effect.

The University of Richmond has a strong system of processes in place to prevent frauds, thefts and mistakes, and protect valuable assets. These control processes are varied and include management sign-off on invoices; employee and manager signatures on time cards; written faculty approval of late grade changes; competitive bidding on large purchases; periodic fire extinguisher testing; virus upgrades on the network; and checking a University ID before resetting a network password.

Some examples of how each of us prevents fraud:

- Senior management respects the processes in place and does not pressure employees to bend the rules, even if they promise to take responsibility. Senior management creates the "Tone at the Top," and they want to set a tone of ethical behavior for the rest of us to follow.

- Employees know the rules and follow the rules. Employees question when someone wants to circumvent the rules and, if necessary, can report concerns to their manager, the internal auditor, or the police.

- Individuals responsible for approving invoices, expense reports, grade changes, leave and vacation records, timecards and other documents take the time to read and understand what they are approving. Making the assumption that "my staff wouldn’t have put this in here for my approval unless they were sure it was OK" not only circumvents the entire process, but actually leaves your valued staff members vulnerable to questions about their involvement if something inappropriate occurs. Don’t approve something without sufficient proof that it is correct.

-

What is a Student Employment Coordinator (SEC)? How do I get set up as a SEC?

The Student Employment Coordinator role is assigned when someone other than the manager is going to initiate creating job requisitions or direct hires on behalf of the manager of the sup org. To request SEC access, submit a Roles and Permissions ticket, and include each JM org for which your SEC access needs to be assigned: https://spidertechnet.richmond.edu/TDClient/1955/Portal/Requests/ServiceDet?ID=54571

-

Whom do I contact with any questions?

Whom you should contact depends on the nature of your student employment question.

Questions related to Federal Work Study (FWS) (ex. determination of students’ eligibility for FWS)

Financial Aid

finaid@richmond.eduQuestions related to direct deposit, W-2s, or hours worked vs paid

Payroll

804-289-8071Questions related to budget

Office of Planning and BudgetOther questions

Student Employment

studentemployment@richmond.edu.